Load-to-truck ratios declined for vans and flatbeds on DAT load boards last week, but the average ratio rose for reefers. Rates lost a penny per mile for each of the three equipment categories, as a national average. These are still strong rates for this time of year, which bodes well for the rest of the third quarter.

Van Demand Stays Hot in August

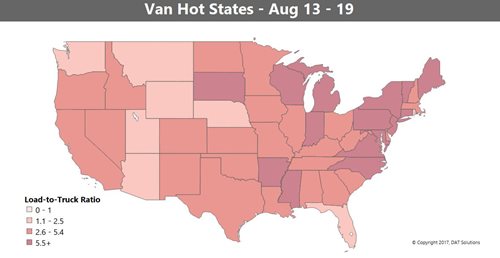

We are in the middle of a seasonal transition, driven largely by produce harvests. Reefers are needed, but anything that affects reefers will affect dry van traffic, as well, so there’s a geographic shift in the van segment. More loads are available in the Upper Midwest and Northeast, while the Southeast is winding down, and trends in the Western region are mixed. The end result is a 1¢ per mile decline in the national average van rate for the week, which is a very small change in an otherwise strong market.

HOT MARKETS – Buffalo recovered last week from a brief decline the week before, and outbound rates rose an average of 5¢ per mile. Buffalo is a key transit point between the U.S. and Canada, so I take this as a sign of increased trade. Columbus, OH is also a hot market for August, and it’s benefiting from the seasonal transition, as well as increased consumer confidence. Freight out of Columbus is associated with retail traffic. Last, and maybe least, Denver is on a hot streak, along with back-haul markets in general.

NOT SO HOT – Philadelphia backed off its previous week’s highs, but outbound rates there are still stronger than they were a month ago. Compared to last week, rates were stable in most other major markets, but if you compare to late July, rates are down in Atlanta, Charlotte and Houston. That’s a typical, seasonal slump for the South.

Reefer Demand Shifts to Midwest and Northeast

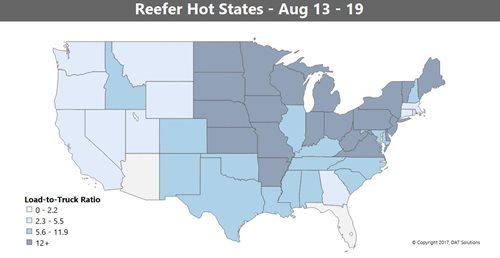

Reefer load posts were up 5% last week, but the national average rate lost 1¢, as noted above. There's a regional shift happening right now, as produce is ripening in the Midwest and parts of the Northeast. You can see the upper band of states turning dark on the Hot States map above, as harvests drive demand, and load-to-truck ratios, in this seasonal transition.

HOT MARKETS – More loads are moving out of the Grand Rapids area, and outbound rates rose in Green Bay and Chicago. More loads left Sacramento last week, too, but it’s still not a high-volume market at this point in the summer, so it didn't make a big regional impact.

NOT SO HOT – Unfortunately, we still haven’t seen the volume we expected out of Fresno. It had a little spike two weeks ago, which raised our hopes, but then rates dropped back down again last week.Ontario, CA volume and rates are declining seasonally, which is expected.