The Patient Protection and Affordable Care Act (PPACA), more commonly known as “ObamaCare,” includes a mandate that most Americans be covered by health insurance or pay a penalty for non-compliance. Individuals will be required to maintain “minimum essential coverage” for themselves and their dependents. Some individuals will be exempt and others will be given financial assistance to pay for their health coverage.

“Very soon, many Americans will face a cost-benefit decision on whether to remain uninsured or pay for health care coverage.”

- Andy Erwin, Tax Services Manager, ATBS |

Below are some key dates and figures you should know now:

- Starting in 2014, if your carrier doesn’t offer health insurance or you are an owner-operator, you will be able to buy it directly in the Health Insurance Marketplace (often referred to as “exchanges”). Individuals and small business will be able to buy health insurance on the exchanges that meet the “minimum essential coverage” definition. The exchanges will offer levels of coverage for consumers to choose from (currently called Bronze, Silver, and Gold for the lowest to highest-cost plans).

- Also effective January 1, 2014, tax credits will become available to those with incomes between 100% and 400% of the poverty line who are not eligible for other affordable coverage.

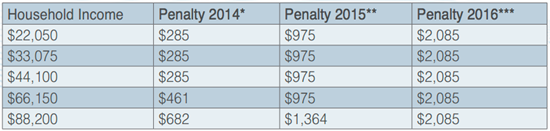

- For individuals that choose to remain uninsured during 2014, there will be a penalty tax levied and it will start being collected on tax returns for 2014 that are filed with the IRS in 2015. The penalty will phase in from 2014 to 2016 and will be based on which is greater: a flat-dollar amount per individual or a percentage of income above the amount that triggers the requirement to file a return. The chart below illustrates potential penalties for a family of four, with a minimum amount of income required to file a return at $20,000.

*Penalty 2014: Greater of $285 or 1% of income over filing requirement

** Penalty 2015: Greater of $975 or 2% of income over filing requirement

*** Penalty 2016: Greater of $2,085 or 2.5% of income over filing requirement

- Some will be exempt from the penalty tax, including those with a household income below the threshold for filing a tax return, those that can’t afford insurance because their premiums exceed 8% of their household incomes, and those who go without coverage for less than three consecutive months during the year.

The bottom line. Very soon, many Americans will face a cost-benefit decision on whether to remain uninsured or pay for health care coverage. For some, the cost of paying the penalty will be much lower than paying for health insurance. Those who don’t pay the fine will not be hit by IRS liens or levies, but the IRS can offset refunds, including those due to refundable credits.

The PPACA is very complex and as more information is released about the details, Team Run Smart will be here to provide you guidance!