Demand for vans continues to heat up on the West Coast, boosting load-to-truck ratios in California, Oregon, Idaho, and Utah. This trend repeats every year, as consumer goods from Asia arrive at the ports and begin the eastward journey to regional distribution centers throughout the country.

Expect the seasonal pressure to continue through much of November, as a massive typhoon in Hong Kong caused scheduling delays on inbound ships at the Ports of Los Angeles and Long Beach, the arrival point for 49% of Asian imports. Ships arrived late, and containers were unloaded and drayed to warehouses late, so that cargo is finally heading east and north. Contract carriers are busy with their regularly scheduled hauls, so a lot of the late-arriving freight gets tendered to brokers and 3PLs.

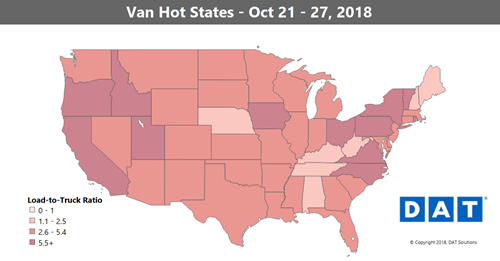

The load-to-truck ratio held steady at 4.7 van loads per truck for the third consecutive week, as heightened demand for trucks in California was offset by a surplus of trucks in major Midwest markets. National average van rates slipped to $2.10 per mile for the month to-date. Van rates are likely to rise again in November and December, as they have in recent years. The map depicts outbound load-to-truck ratios by state, for dry van freight. The load-to-truck ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates.

Those brokers turn to the spot market for help finding trucks. On Friday, outbound loads outnumbered available trucks in the L.A. market by more than 10-to-1 on DAT Load Boards. Truckers stepped up, to move 35% more loads last week on six of the busiest lanes out of L.A. The additional pressure gave rates a lift on four of those lanes: L.A. to Chicago, Dallas, Phoenix, and Denver. Rates fell on the lanes from L.A. to Atlanta and Seattle, however.

Bucking the trend, volume declined last week on the number-one outbound lane from L.A. to Stockton, possibly due to expanded capacity at the Ports of Stockton and Oakland. Some shippers preferred to deliver cargo there by sea, bypassing the Los Angeles-area ports altogether.

Hot Markets

Apart from Los Angeles, the biggest increase last week on a lane-by-lane basis was actually out of Denver.

- Denver to Dallas paid 18¢ more, but the average is still only $1.34/mile

- Buffalo to Allentown, PA, was up 15¢ to $3.40/mile

- Chicago to Dallas also bounced back, up 12¢ to $2.29/mile

Not So Hot

There were still more lane rates going down than up last week, with prices falling on 60 of the top 100 van lanes. Prices between Columbus, OH, and Buffalo, NY, fell in both directions.

- Columbus to Buffalo fell 18¢ to land at $3.45/mile

- Buffalo to Columbus dropped 19¢ to $2.01/mile

- Denver to Oklahoma City plummeted 24¢ to $1.38/mile

Freightliner’s Team Run Smart is partnering with DAT to offer a special on the TruckersEdge load boardto its members. Sign up for TruckersEdge today and get your first 30 days free by signing up at www.truckersedge.com/378402 or entering “promo717” during sign up.

* This offer is available to new TruckersEdge subscribers only

About TruckersEdge®, powered by DAT®

TruckersEdge® Load Board is part of the trusted DAT® Load Board Network. DAT offers more than 68 million live loads and trucks per year. Tens of thousands of loads per day are found first or exclusively on the DAT Network through TruckersEdge.

This article was originally featured on DAT.com.