When it comes to how much money you should be saving every month, the answer isn’t cut and dry. Not surprisingly, the amount of money you need to save depends on a variety of things.

Obviously, the amount of cash you can stash away each month is going to be somewhat commensurate with your income level. This is why most financial experts recommend percentages instead of hard and fast dollar amounts.

So, just what is a good percentage to be saving every month? Well, unfortunately, there is no one-size-fits-all answer. In order to determine how much you need, you must first define a budget and determine your financial goals. If you’re ready to figure out how much money you need to be stockpiling each month, keep reading.

Budgeting Your Money

The first thing you need to do before deciding how much money to save each money is to make a budget. In order to make a budget, you need to know how much money is coming in and how much money is going out each month.

Although you might think you know what you’re spending, unless you track it and see it on paper or a computer screen, there’s a high probability that your assumptions are way off.

Before I started tracking my income and expenses, I had no idea I was spending hundreds of dollars in restaurants every month. Not only was I eating crappy food, I was also wasting a lot of money and losing the opportunity to save or make payments toward my debt.

By tracking my money for a few months, I was able to identify how much I was spending in each category. After I knew my numbers, it was easy to make adjustments to save more money.

As mentioned, the first step in budgeting is to track your money like I did. I’m willing to bet you might also find a few financial leaks after tracking your money for a few months. Once you have your numbers, you’ll be ready to start your monthly budget.

Budgeting can be as easy or as time-consuming as you want it to be. So if the idea of spending gobs of time on a budget gets you excited, check out this cool tool that allows you to track every single dollar.

If, however, the thought of spending hours each month on your budget makes you cringe, don’t worry, there’s a popular rule floating around that doesn’t require complicated spreadsheets or a degree in finance.

It’s known as the 50/20/30 rule.

The 50/20/30 Rules states simply:

- 50 percent of your income should go toward necessary living expenses. Things like your rent/mortgage, food, utilities, and transportation should go into this category.

- 20 percent of your income should go toward saving money to meet financial goals. This money should be directed toward an emergency fund, debt repayment, saving for retirement, etc.

- 30 percent of your income should go toward the fun stuff like a night out when you’re home or vacations.

When Should You Start Saving?

I’m sure you heard that you need to start saving young if you ever want to retire. And while starting young is ideal, it’s not always an option if you have more than a few years under your belt.

Although I started to save money when I was in my early 20s, I allowed life to get in the way (think: bad relationships and credit card debt) and I didn’t keep it up. Unfortunately, I allowed about a decade to pass without any significant amount of money being directed toward saving.

Thankfully, I didn’t allow that decade of bad money moves to get me down and stop me from turning my finances around when I was in my late 30s. A few years later, I have my money under control and I’m well on my way to a secure financial future. It’s amazing how much progress you can make if you just resolve to do so.

So, if you happen to still be young, that’s great, you have time on your side and can take full advantage of compound interest. If, on the other hand, you don’t happen to be young, starting now is your only option. And starting now is better than starting next year or not at all.

No matter your age, take advantage of it by starting to save as soon as possible.

Your Personal Savings Rate

What happens if you don’t make enough money to start saving 20 percent right away? Don’t beat yourself up. 20 percent is a lofty savings rate that not everyone can achieve overnight.

When I started taking my finances seriously, I wasn’t even close to 20 percent. But, little by little, year after year, I was able to earn more money and make adjustments to my spending habits that allowed me to step up my savings game.

I would recommend you start saving as much as you can comfortably afford each month. Then, work on optimizing your budget by increasing your income and reducing expenses. Before you know it, you’ll be able to increase your savings rate by one percent here and one percent there.

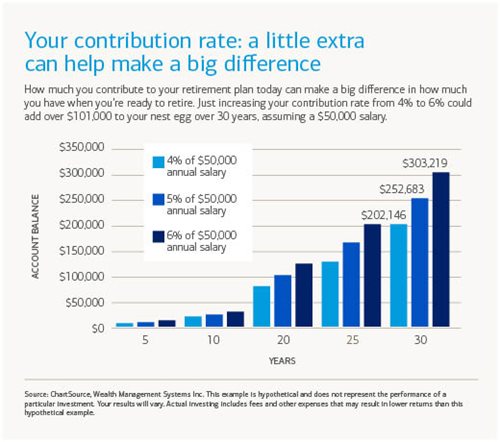

And believe it or not, one percent makes a huge difference in your bottom line over the long haul. Don’t believe me? Check out these stats:

Photo Credit: Bank of America/Merrill Edge

Simple Steps To Increase Your Savings Rate

Fortunately, there are quite a few things you can do to increase your savings rate over time. You can either focus on earning more money, decreasing expenses, or doing both. Doing both is my personal favorite and below are a few tips for each strategy.

Ideas To Increase Your Income:

Ideas To Decrease Your Expenses:

- Negotiate better interest rates on credit cards

- Get a cheaper mobile phone plan

- Cut out bad habits like smoking or drinking

- Combine trips to save on gas

- Reduce or eliminate your cable bill

Your Buckets Of Cash

After you have established and optimized your budget, you’ll be able to funnel money into different buckets for different savings goals.

Your buckets of cash might not be the same as mine, but there are a few buckets that are universal.

Universal buckets typically include emergency funds and retirement accounts. Additional buckets that are generally common include travel funds, wedding funds, and house funds.

How much you dump into each bucket is a personal decision and based on your risk tolerance, lifestyle, and how much money you want waiting for you at the end of your working career.

So, just how much money should you be saving each month? The easy answer is as much as you can. By saving as much money as you can comfortably afford and incrementally increasing the percentage whenever you have the opportunity, you’ll find yourself solidly planted on the road to financial security. Go forth and save on!