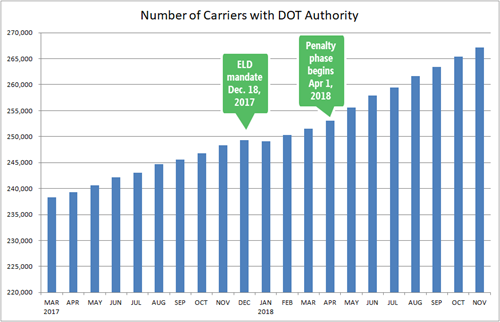

Four months before the ELD mandate took effect on Dec. 18, 2017, DAT surveyed TruckersEdge users to learn how they planned to deal with the new regulation. Most of the respondents were owner-operators and small carriers, and 30% of them said that they would leave the industry rather than use an ELD.

That didn't happen. While some may have followed through on that threat, the number of active carriers actually has actually grown at a faster rate since the mandate went into place. So, what changed?

More money, more carriers

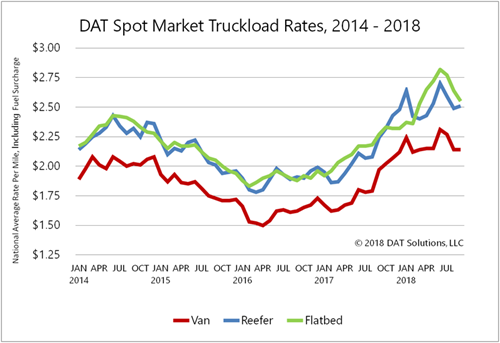

In late December 2017 and early January 2018, the combination of a strong economy, holiday-related e-commerce freight, rebuilding efforts following hurricanes Harvey and Irma, and uncertainty around ELDs pushed rates to the highest level DAT ever recorded. The average spot market rate for van freight shot up from $1.67/mile in January 2017 to $2.24/mile in January 2018. Why leave the industry when you're making the best money in years?

And with rates so high, many company drivers and owner-operators who were previously leased-on decided to go independent and start their own carrier businesses.

Rates surged to record highs in January 2018, and rose even higher in June.

Fewer miles, more money

Just because carriers didn't hang up the keys doesn't mean their productivity wasn't impacted by the ELD mandate. What were once one-day trips spilled into a second day, as electronic logs provided less flexibility when recording hours of service, and some carriers struggled to adapt to changes in HOS enforcement.

Carriers bracing for reduced income due to reduced miles discovered something instead: the higher rates in peak seasons made up for the loss of miles. Those who stuck it out were rewarded again in June when van rates hit $2.31/mile, another record high.

Will things slow down in 2019?

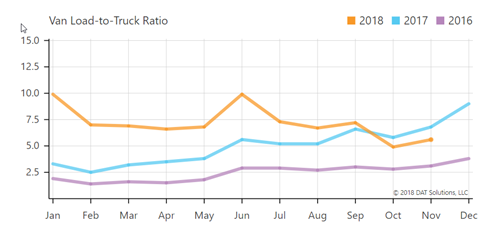

Now, one year after the ELD mandate, carriers seem to have adjusted, and demand-capacity measures are returning to more normal levels. In the chart above, you can see where the van load-to-truck ratio hit a peak of 9.9 in both January and June but has since dropped to below 2017 levels.

Load-to-truck ratios represent the number of loads posted for every truck posted on DAT Load Boards, and indicate of the balance between spot market demand and capacity. If prices follow suit, it's likely that the pace of new carriers entering the marketplace will slow. Some of those who originally threatened to quit may decide to leave the industry later than they originally thought.

Freightliner’s Team Run Smart is partnering with DAT to offer a special on the TruckersEdge load boardto its members. Sign up for TruckersEdge today and get your first 30 days free by signing up at www.truckersedge.com/378402 or entering “promo717” during sign up.

* This offer is available to new TruckersEdge subscribers only

About TruckersEdge®, powered by DAT®

TruckersEdge® Load Board is part of the trusted DAT® Load Board Network. DAT offers more than 68 million live loads and trucks per year. Tens of thousands of loads per day are found first or exclusively on the DAT Network through TruckersEdge.

This article was originally featured on DAT.com.