So far, the national averages for spot market rates in October are the highest they've been since the Snowpocalypse of 2014. Back then, it was a series of winter storms that disrupted supply chains and pushed load-to-truck ratios unusually high for several months. Just two weeks ago, we reported the highest national van load-to-truck ratio ever recorded in DAT Trendlines, which we've published every week since 2010.

Even if the spot market does start to loosen in the next few weeks, there's still the ELD mandate lurking right around the corner, which could add more pressure on rates to go up.

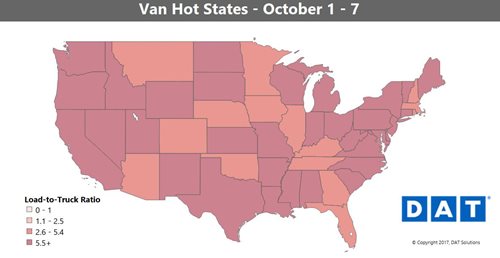

For van freight, we’re starting to see hot markets shift westward, with big rate increases out of Seattle, Los Angeles, Denver and Stockton, CA. We’re also seeing signs that things are finally starting to slow in the Midwest, but rates there are still high.

Outbound van rates have soared more than 40% in Seattle in the past month. Seattle is normally a backhaul market, meaning that outbound rates are usually quite a bit lower than the inbound rates. Load-to-truck ratios have been high throughout the Pacific Northwest, though, with higher reefer load counts in the region contributing to tighter van capacity. That meant that fewer reefer trucks were competing for van loads. Rerouted port traffic from Houston to Seattle after Hurricane Harvey may have added to demand for trucks in the area.

Rates below include fuel surcharges and are based on real transactions between carriers and brokers.

RISING LANES

Almost all the biggest price increases were out West

- Seattle to Eugene, OR surged 70¢ to an average of $3.14/mile

The roundtrip rate between Seattle and Stockton got a raise in both directions:

- Seattle to Stockton climbed 55¢ to $1.96/mile

- Stockton to Seattle added 33¢ to $2.79

The same was true for roundtrips between Portland, OR and Stockton:

- Stockton to Portland was up 28¢ to $2.92/mile

- Portland to Stockton added 44¢ for a $2.04/mile average

The biggest increases back East came out of Buffalo:

- Buffalo to Allentown, PA gained 29¢ at $3.61/mile

- Buffalo to Columbus climbed 28¢ to $2.57

FALLING LANES

Columbus, OH, has been one of the hottest van freight markets ever since Hurricane Harvey caused massive disruptions, but rates have started to normalize. Prices are still way above seasonal norms, but they’re not quite as high as they were 2-3 weeks ago.

- Columbus to Buffalo fell 19¢ but still averaged $3.42/mile

- Columbus to Allentown was down 14¢ to $3.72/mile

- Columbus to Memphis also dropped 13¢ to $2.15/mile