For pay miles most trucking companies use “Map Miles” or the shortest route mileages, like the Rand McNally mileage guides. Often, the trip cannot be made driving the shortest distance as used in Map Miles for one reason or another. This means you’re driving more miles than are shown on your settlement and this can seem unfair.

Using Map Miles or short route miles have been accepted trucking industry standards for many years. When numerous aspects of the trucking industry are continuously evolving and changing, it’s surprising that this has been something that’s stuck around just because it is the “industry standard.” However, using Map Miles is what shippers are accustomed to. Shippers trust them, and since they are paying the bills, change will likely be slow.

Until this process changes, here are some things to consider:

- Carriers use the same miles to calculate the shipper’s rate and the driver’s settlement. An invoice sent to the shipper based on Map Miles for the trip means the driver gets a settlement based on the same Map Miles. There’s no difference in miles for the shipper or the driver.

- Map Miles may not be the practical miles but the size of the revenue pie isn’t going to change much just because the miles paid better match the miles driven. It might make you feel better seeing miles driven match closer to miles paid, but it’s probably unrealistic to believe there will be more pay by simply changing mileages. Logically, what shipper accepts a rate increase by increasing miles?

- If you don’t want to use Map Miles, which miles do you want to use? If one driver gets lost, another runs out of route to stop at the store, and another driver’s GPS gives instruction for a longer route, whose miles are going to be accepted? Map Miles at least provide a standard for now that is used between different shippers and carriers.

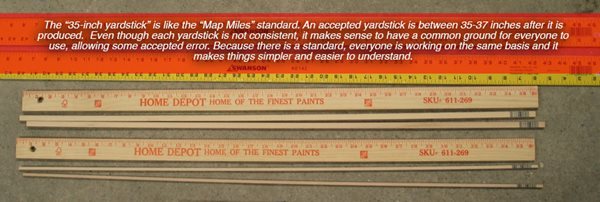

The “35-inch yardstick” is a common analogy that can be used for understanding the Map Miles practice. An accepted yardstick is actually somewhere between 35-37 inches after it is produced. Even though each yardstick is not consistent, it makes sense to have a common ground for everyone to use, allowing some accepted error. Because there is a standard, everyone is working on the same basis and it makes things simpler and easier to understand.

What about deducting the difference between Map Miles and actual miles from your taxes? The IRS will not accept the difference between actual miles and Map Miles as a separate tax deduction. They see that as “double-dipping” since the cost has already been deducted once in your usual expenses when items such as fuel and maintenance are paid. So the answer is no, the IRS does not consider the mileage difference an extra expense for tax deductions.

The 35-inch yardstick is not perfect. I get it. Map Miles is not perfect either, but until a better system comes along, we can be grateful for a pay standard that makes things simpler across the industry.