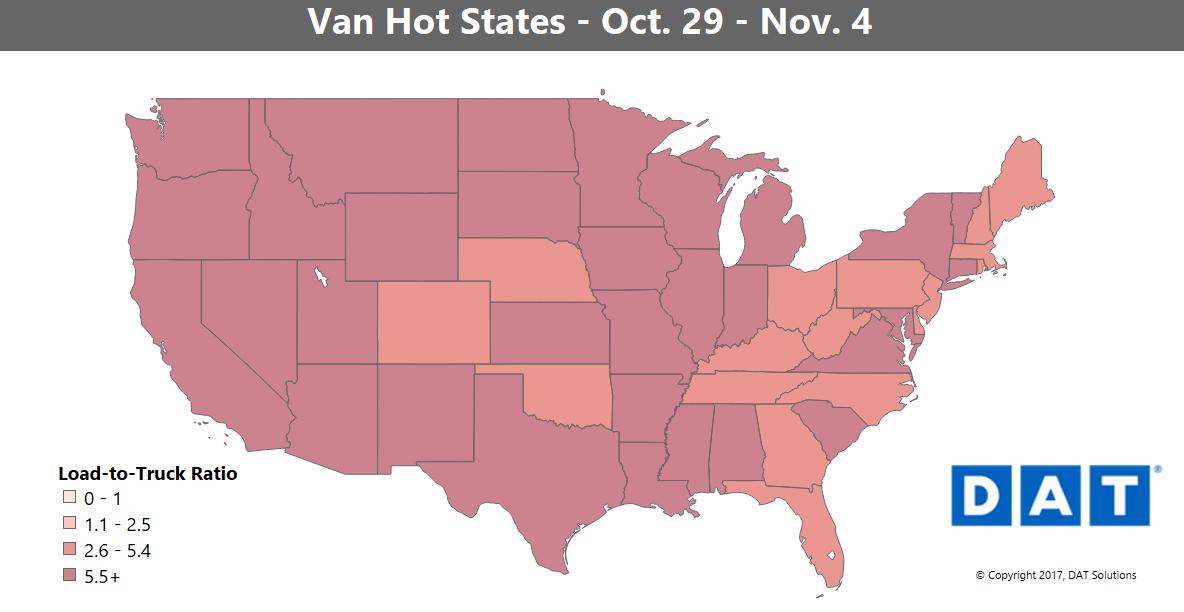

Spot market volumes got a bump at the end of October, and those load counts held steady heading into the first week of November. The tight capacity pushed spot market van rates higher across much of the country, as prices rose on 58 of the top 100 van lanes.

For more than a month now, rates have averaged above $2.00/mile, which is way higher than usual for this time of year. How much longer is that going to last? It could be a couple more months, at least. Retail freight is expected to be more plentiful this year, and port traffic is way up. With the ELD mandate coming in December, it seems likely that prices will stay above normal for a while. Demand usually tapers off in February, so rates could slip lower then, until activity picks up again in the spring.

Los Angeles was the number 1 market for van loads again last week, and the load-to-truck ratio is still in the double digits – so it’s no surprise that outbound rates rose 5%. Chicago rebounded, with improved volumes and higher rates on several key lanes. With retail season upon us, the general trend is for higher rates on eastbound lanes, with more demand for deliveries into the population centers in the Northeast.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

Rising Lanes

Last week’s biggest increase was on the lane from Columbus to Buffalo, up 30¢ more for an average of $3.46/mile.

Most of the other big jumps were on lanes out of Chicago and Los Angeles:

- Chicago to Columbus was up 20¢ at $3.36/mile

- Chicago to Atlanta also gained 17¢ at $2.91/mile

- Out West, L.A. to Phoenix was up 13¢ to $2.79/mile

- Los Angeles to Dallas rose 15¢ at $2.26/mile

- L.A. to Chicago climbed 11¢ to $1.81/mile – that doesn’t sound so high compared to the other lanes we’ve mentioned, but this is a top intermodal lane, so $1.81 is a high rate considering the railroad competition

Falling Lanes

Prices on a handful of lanes dropped back down from their previous highs.

- Seattle to Eugene, OR had the biggest decline, down 26¢ to $2.26/mile

- Seattle to Spokane also dropped 17¢ to $2.82/mile

Rates rising in most other places meant that the some backhaul lanes out of Denver took a step back – what else is new?

- Denver to Stockton rates were down 13¢ at $1.31/mile, but the headhaul from Stockton was up 14¢, so the roundtrip average is pretty much the same as last week

- One of the few head haul lanes out of Denver is to Albuquerque, but even it was down 13¢ at $1.96/mile

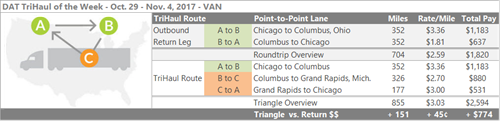

The higher rates on the van lane from Chicago to Columbus led to rates falling on the return trip, but since Columbus is an outbound hub for freight to many other markets, you can put together a TriHaul that boosts your average rate per loaded mile.

Columbus to Chicago averaged $1.81/mile last week, which still makes for a good round trip, but instead of heading straight back to Chicago, you could haul a dry van load from Columbus to Grand Rapids, MI. That paid an average of $2.70/mile last week. The last leg of the trip would be a short haul from Grand Rapids to Chicago, which paid $3.00/mile on average.

Not counting deadhead, the TriHaul adds about 150 miles, and if you just negotiated the average rate on every load, your average for the whole trip would go up from $2.59/mile to $3.03. That’s an extra $774 in your pocket if you can make it work with your hours.

Freightliner’s Team Run Smart is partnering with DAT to offer a special on the TruckersEdge load boardto its members. Sign up for TruckersEdge today and get your first 30 days free by signing up at www.truckersedge.net/promo717 or entering “promo717” during sign up.

* This offer is available to new TruckersEdge subscribers only

About TruckersEdge®, powered by DAT®

TruckersEdge® Load Board is part of the trusted DAT® Load Board Network. DAT offers more than 68 million live loads and trucks per year. Tens of thousands of loads per day are found first or exclusively on the DAT Network through TruckersEdge.

This article was originally featured on DAT.com.