This blog is for owner operators as the PerDeim changed for drivers. The main issue is the On Duty Not Driving - if you are working on anything truck related no matter where you are even at home legally that is On Duty Not Driving.

IRS Publication 463

Your duties require you to be away from home. You must sleep or rest to meet the demands of your work while away from home.

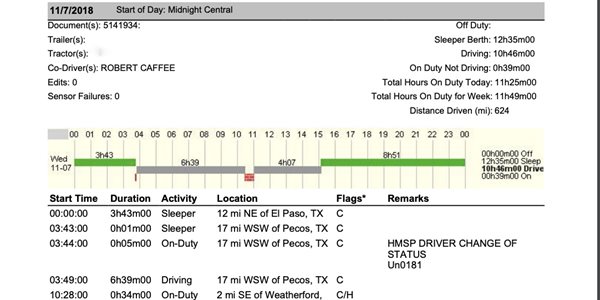

Driving a truck, the per diem is days spent away from home which means you are working. If you are working at home on truck related work that is not a per diem day. This work at home and going to sleep at home should be logged as on duty not driving.

There seems to still be confusion between hours of service and per diem.

If working at home on truck related items such as looking for a load, buying food for the truck, or working on the truck you are on duty not driving and this is not a per diem day. To get per diem you have to spend the night away from home due to work.

Here is an example of a terminal situation taken from IRS Publication 463:

Terminal not in your home town (terminal is where you park your truck)

Example 1. You are a truck driver and you and your family live in Tucson. You are employed by a trucking firm that has its terminal in Phoenix. At the end of your long runs, you return to your home terminal in Phoenix and spend one night there before returning home. You can’t deduct any expenses you have for meals and lodging in Phoenix or the cost of traveling from Phoenix to Tucson. This is because Phoenix is your tax home.

Example 2. You are a truck driver. You leave your terminal and return to it later the same day. You get an hour off at your turnaround point to eat. Because you aren’t off to get necessary sleep and the brief time off isn’t an adequate rest period, you aren’t traveling away from home.

Seems to be clear cut to me that if working at home on truck related work you should log on duty not driving.

If in the truck working away from home depending on when you leave the house this will be a partial or full per diem day.

For more information on this subject call ATBS 888.640.4829, or visit the ATBS website and read IRS Publication 463