Keeping up with the Jones' is not a realistic goal as we need to keep up with ourselves. While listening to a podcast the other day from the Money Guy

I learned a few disturbing facts.

- 60% of Americans cannot put their hands on $1000 available cash

- Average credit card debt is $16,000 dollars

- The expensive car is often the calling card or how well we are doing and is usually financed for 68 months or on a lease and never owned.

- Peer Pressure – We buy more than we can afford to keep up with our circle of friends

- Keep swimming upstream, buy a bigger house – need more furniture – better yard – better car

- Nearly 75% of adult children are getting help from their parents

What we do not know about the “Jones”

- Is everything bought on credit?

- Are their parents or family giving them money?

- Is everything on a lease purchase?

- Are they living for the day and hoping to inherit so they can retire?

Why do we care what the “Jones” are doing? How can it benefit us if we compare what we do to others?

- Don’t face success by borrowing against your future

- Less than 25% of monthly income used for housing, this includes taxes, utilities, insurance, or all in

- Pay off automobiles in three years no matter how long the term of the loan

- Credit Cards paid off monthly

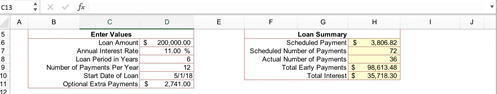

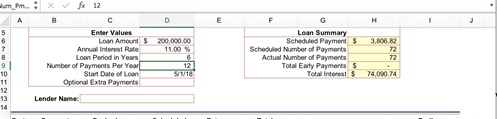

Get a good Amortization Schedule to see what is happening or how a small change can increase your savings or decrease a bill. Before making a big purchase on credit run the debt through an amortization schedule to see if you can really afford the item and how quickly the debt can be paid off. For each truck we have purchased we have set up the loan for the maximum amount of time possible for the just in case scenario and then used the amortization schedule to set up the payment to pay off in the maximum of three years. We have been able to pay off all of trucks in less than three years as we have made this a high priority. It sure feels like a paid in full truck drive better than a truck that has debt attached to it.

What kind of freedom can we have with no debt and taking a vacation that is paid for?

Quit wasting energy worrying about what others are doing and worry about your own situation and goals.

Remember a dream is not a plan until written down and a process figured out on how to make the dream a reality.

A really good book to read is “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

What happens to interest paid when we go to three years?